Agenda¶

- Loans 101

- Survival Analysis

- Metrics

- Lending Club

- Machine Learning

- Summary

Loans 101¶

Loans 101¶

From the lender's perspective:

- $P_0$, initial investment (dollars out)

- $c$, sequence of payments (dollars in)

- $r$, interest rate (annualized)

- $T$, term of the loan (e.g., 36 months)

- arbitrage: these two cash flows must be equivalent

However, this isn't immediate:

$$ \begin{align*} P_0 \utif^ T \ne c T \end{align*} $$

Loans 101: Amortization¶

The resolution is straightforward:

$P_0$ is lent at time 0.

$P_1$ = $\utif P_0 - c \qquad$ At time 1, $\utif P_0$ is owed and $c$ is paid.

Recursing,

$$ \begin{align*} P_k & = \utif P_{k-1} - c \\ & = \utif \left[ \utif P_{k-2} -c \right] - c \\ & = \utif^k P_0 - c \sum_{i=0}^{k-1} \utif^i \end{align*} $$

At time $T$, $P_T = 0$: the loan is paid off.

Loans 101: An arbitrage condition¶

$P_T = 0$ implies:

$$ \begin{equation*} \utif^T P_0 = c \sum_{i=0}^{T-1} \utif^i \end{equation*} $$

Note, each payment must be reinvested.

Implications¶

- Positions may need to be unwound.

- Any risk persists with each reinvestment.

- Survival analysis "makes sense."

- Generalizations exist for arbitrary time steps, arbitrary payments.

- Internal Rate of Return

Survival Analysis¶

Survival Analysis: Kaplan Meier¶

$$ \begin{align*} \mathcal{F}(y) & = \prod_{i:t_i < y} \left( 1 - h_i \right) \end{align*} $$

Survival Analysis: Notation¶

$$ \begin{align*} \widehat{\mathcal{F}}(y) & = \prod_{i:t_i < y} \left( 1 - \hat{h}_i \right) \\ & = \prod_{i:t_i < y} \left( 1 - \frac{a_i}{r_i} \right) \end{align*} $$

- $r_i$ the count of units not yet failed or censored at $t_i$, the "risk set"

- $a_i$ is the count of units that fail in $[t_i, t_{i+1})$

- discrete accounting at fixed times; e.g., end of month

Survival Analysis: Definitions¶

$$ \begin{align*} \mathcal{F}(y) & = \prp{Y \geq y} & \mbox{survival probability} \\ h(y) & = \underset{\Delta \to 0}{\lim} \prp{ y\leq Y < y + \Delta \vert Y \geq y} & \mbox{continuous hazard} \\ & = f(y) / \mathcal{F}(y) \\ h_k & = \prp{ Y = t_k \vert Y \geq t_k } & \mbox{discrete hazard} \\ H(y) & = \int_0^y h(u) du & \mbox{integrated hazard function} \end{align*} $$

Parametric modeling is often via the hazard function.

Survival Analysis: Likelihood¶

Add in censoring:

$d_i = 1$ indicates an observation, $y_i$, is an uncensored failure time; $d_i = 0$, a censored failure time

$$ \begin{align*} l(\theta) & \equiv \sum_{i \in \mathcal{U}} \log f(y_i; \theta) + \sum_{i \in \mathcal{C}} \log \mathcal{F}(y_i) \\ \end{align*} $$

When failure is possible only at discrete times,

- $f(y_i)$ and $\mathcal{F}(y_i)$ have telescoping expansions in terms of $h_k$ and $(1-h_k)$; and

- apply a "ragged pivot": aggregate terms over time instead of over unit

$$ l(\theta) = \sum_{k \in \mathcal{T}} \left\{ a_k \log h_k + (r_k - a_k) \log (1-h_k) \right\} $$

Survival Analysis: Modeling¶

Non-parametric $h_k$¶

Set $\frac{\partial l(\theta)}{\partial h_k} = 0$ to recover Kaplan-Meier estimator.

Parametric $h_k(\theta)$¶

If discretized in time:

- Likelihood is a collection of binomial distributions with denominator $r_k$

- Model probabilities are derived via integrated hazard function

Survival Modeling: Hypothesis testing¶

For each $t_k$, a 2 by 2 contingency table:

| Group A | Group B | Total | |

|---|---|---|---|

| failed | \begin{equation*} a_{k,1} \end{equation*} | $a_{k,2}$ | \begin{equation*} a_{k,1} + a_{k,2} \end{equation*} |

| survived | \begin{equation*} r_{k,1} - a_{k,1} \end{equation*} | \begin{equation*} r_{k,2} - a_{k,2} \end{equation*} | \begin{equation*} (r_{k,1} + r_{k,2}) - (a_{k,1} + a_{k,2}) \end{equation*} |

| total | \begin{equation*} r_{k,1} \end{equation*} | \begin{equation*} r_{k,2} \end{equation*} | \begin{equation*} r_{k,1} + r_{k,2} \end{equation*} |

Test statistic under null hypothesis is hypergeometric:

$$ A_{k,1} \sim \frac{ {{a_{k,1} + a_{k,2}} \choose a_{k,1}} {{(r_{k,1} + r_{k,2}) - (a_{k,1} + a_{k,2})} \choose {r_{k,1} - a_{k,1}}} } { r_{k,1} + r_{k,2} \choose r_{k,1} } $$

Log rank statistic: aggregate across the time index, $\mathcal{T}$: $$ Z = \frac{ \sum_{k \in \mathcal{T}} (A_{k,1} - \Ev{A_{k,1}}) }{ \sqrt{ \sum_{k \in \mathcal{T}} \Var{A_{k,1}} } } $$

Metrics¶

Metrics: Internal rate of return¶

For a cash flow with no risk of default, IRR is the $r$ that satisfies the earlier arbitrage condition:

$$ \begin{align*} \utif^T P_0 = c \sum_{i=0}^{T-1} \utif^i \end{align*} $$

We write the present value of the cash flow as

$$ \begin{align*} P_0 = \frac{1}{\utif}c + \frac{1}{\utif^2}c + \cdots + \frac{1}{\utif^T}c \end{align*} $$

and the idea is to appropriately discount each future installment.

Metrics: stochastic discount factors¶

Let $W_T^{(0)}$ be a portfolio with present value \$1; annualized interest rate, $r$; an installment of $f = c / P$, and $T$ payments remaining.

arbitrage requirement¶

$$ \begin{align*} \Ev{ W_T^{(0)} } & = \Ev{ D_{1,0} \left( W_{T-1}^{(0)} + f W_{T}^{(1)} \right) } \\ \end{align*} $$

Metrics: arbitrage requirement¶

$$ \begin{align*} \Ev{ W_T^{(0)} } & = \Ev{ D_{1,0} \left( W_{T-1}^{(0)} + f W_{T}^{(1)} \right) } \\ & = \Evk{ D_{1,0} \left. \left( W_{T-1}^{(0)} + f W_T^{(1)} \right) \right\vert Y^{(0)} \geq 1 } \prp{ Y^{(0)} \geq 1 } + 0 \\ & = \frac{ \prp{ Y^{(0)} \geq 1 } }{ \utif } \left\{ \Evk{ \left. W_{T-1}^{(0)} \right\vert Y^{(0)} \geq 1 } + f \Ev{ W_T^{(1)} } \right\} \\ & = d_{1,0} \Evk{ \left. W_{T-1}^{(0)} \right\vert Y^{(0)} \geq 1 } + d_{1,0} f \Ev{ W_T^{(1)} } \end{align*} $$

We can apply the above argument recursively:

$$ \begin{align*} 1 & = \Ev{ W_T^{(0)} } \\ & = d_{1,0} f + d_{2,1} d_{1,0} f + \cdots + \left( d_{T,T-1}\cdots d_{1,0} \right) f \end{align*} $$

yielding the risk-neutral discount terms

$$ d_{k,0} = d_{k,k-1}\cdots d_{1,0} = \frac{ \prp{ T^{(0)} \geq k } }{ \utif^k } $$

Metrics: Risk neutral IRR¶

We can now meaningfully compute a risk-neutral IRR, $r^*$, for the weighted cash flow:

$$ \begin{align*} P_0 = \frac{\prp{ Y^{(0)} \geq 1 } }{\rnutif}c + \frac{\prp{ Y^{(0)} \geq 2}}{\rnutif^2}c + \cdots + \frac{\prp{ Y^{(0)} \geq T}}{\rnutif^T}c \end{align*} $$

Metrics: Probability of repayment¶

Trivial from KM curve, $\prp{ Y \geq T }$

Potentially useful as:

- an ethical lending constraint;

- a component of a credit score; e.g., the maximal risk-neutral IRR on a loan amount set to 10% of income that has at least a 95% chance of repayment

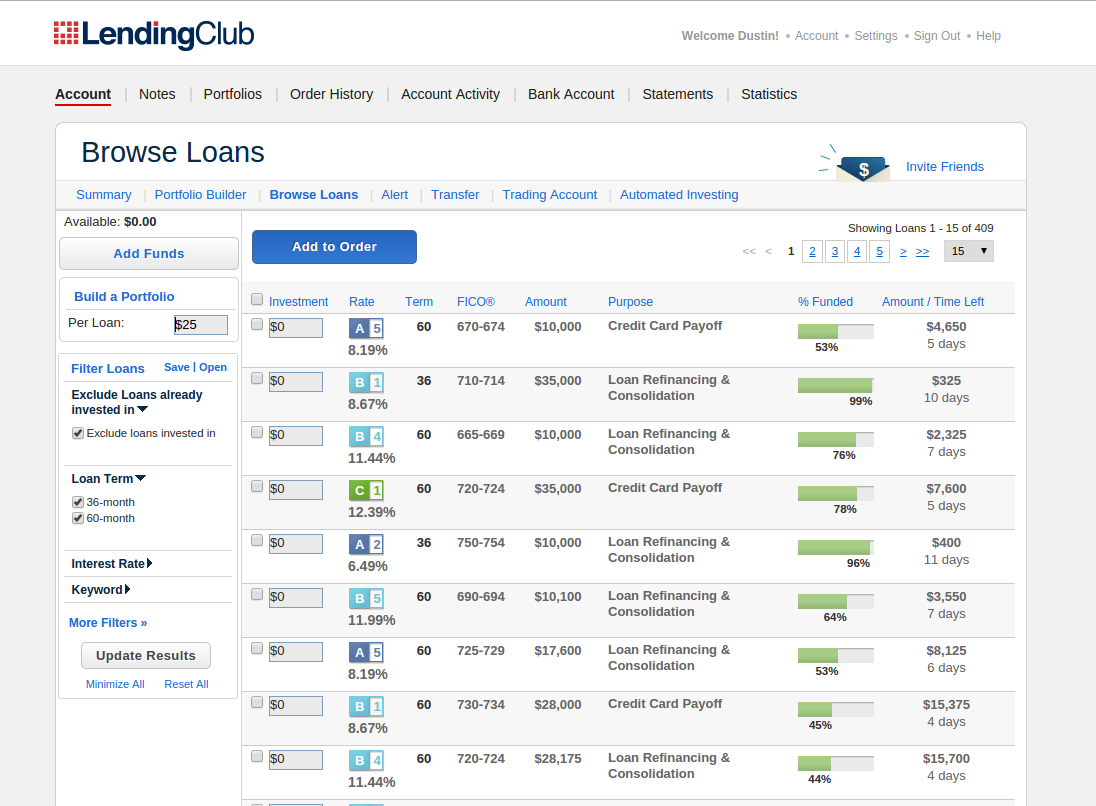

Lending Club¶

Lending Club: Covariate set, at origination¶

| column | description |

|---|---|

| loan-amnt | loan amount requested |

| funded-amnt | loan amount funded |

| int-rate | interest rate on loan |

| installment | monthly payment |

| grade | loan quality grade |

| sub-grade | loan quality subgrade |

| purpose | loan category: DEBT-CONSOLIDATION, MEDICAL, ETC. |

| emp-length | employment length |

| home-ownership | home ownership status: RENT, OWN, MORTGAGE, OTHER |

| annual-inc | self reported annual income |

| is-inc-v | income verified |

| fico | FICO score |

| dti | debt to income ratio |

| earliest-cr-line | date of earliest reported credit line |

| open-acc | number of open credit lines |

| revol-bal | total credit revolving balance |

| revol-util | percent credit used |

| total-acc | total number of credit lines in credit file |

| delinq-2yrs | number of 30+ days past-due incidences of delinquency in credit |

| inq-last-6mths | number of inquiries by creditors in the past 6 months |

| mths-since-last-delinq | months since the borrower’s last delinquency |

Lending Club: Covariate set, post-origination¶

| column | description |

|---|---|

| loan-status | current status of the loan: Charged Off, Current, Fully Paid |

| total-rec-int | interest received to date |

| total-rec-prncp | principal received to date |

| total-rec-late-fee | late fees received to date |

| out-prncp | remaining outstanding principal for total amount funded |

| total-pymnt | payments received to date for total amount funded |

| last-pymnt-d | last date payment was received |

| next-pymnt-d | next scheduled payment date |

| pymnt-plan | indicates if a payment plan is in place for the loan |

Lending Club: Challenges¶

The full cash flow is unavailable. For post-origination, on the day of data collection, we know only:

- last and next payment dates

- total principal, interest, and fees paid out

- loan status: current, paid, late, very late, charged off

no visibility into timeliness or completeness of payments

Difficult to establish a time of default or assess prepayment risk

"""

Three estimators of loan length:

a. last recorded payment -- "dur_last_pymnt_date"

b. number of installments paid -- "dur_total_installment"

c. interest paid out -- "dur_total_interest"

"""

examples

| charged off | prepayment | standard | malformed loan | |

|---|---|---|---|---|

| loan_amnt | 1800 | 20000 | 18000 | 7500 |

| int_rate | 11.89 | 11.78 | 14.72 | 13.8 |

| term | 36 | 36 | 36 | 36 |

| installment | 59.7 | 662.19 | 621.52 | 236.86 |

| issue_d | 2008-12-05 | 2008-12-05 | 2010-08-06 | 2008-09-26 |

| last_pymnt_d | 2010-03-30 | 2010-09-08 | 2013-08-22 | 2011-09-29 |

| total_pymnt | 673.21 | 23036.2 | 22368.3 | 8526.93 |

| total_rec_prncp | 436.01 | 20000 | 18000 | 6950 |

| full_interest | 349.2 | 3838.84 | 4374.72 | 1026.96 |

| total_rec_int | 160.99 | 3003.13 | 4368.26 | 1576.93 |

| loan_status | Charged Off | Fully Paid | Fully Paid | Fully Paid |

| dur_last_pymnt_date | 15.7703 | 21.0928 | 36.5346 | 36.0747 |

| dur_total_installment | 11.2765 | 34.7879 | 35.9896 | 35.9999 |

| dur_total_interest | 10.134 | 19.9876 | 35.1976 | 24.7193 |

Machine Learning¶

Machine Learning: Where to start?¶

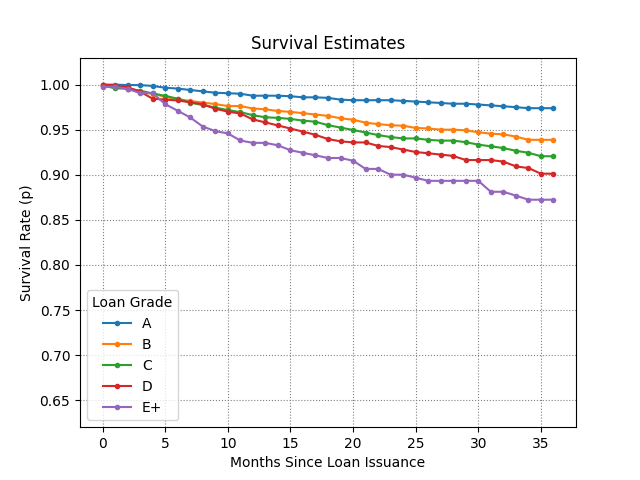

- We can estimate survival curves for sets of loans (Kaplan Meier).

- We can quantify the difference equivalence classes (log rank statistic).

- We don't want to work too hard.

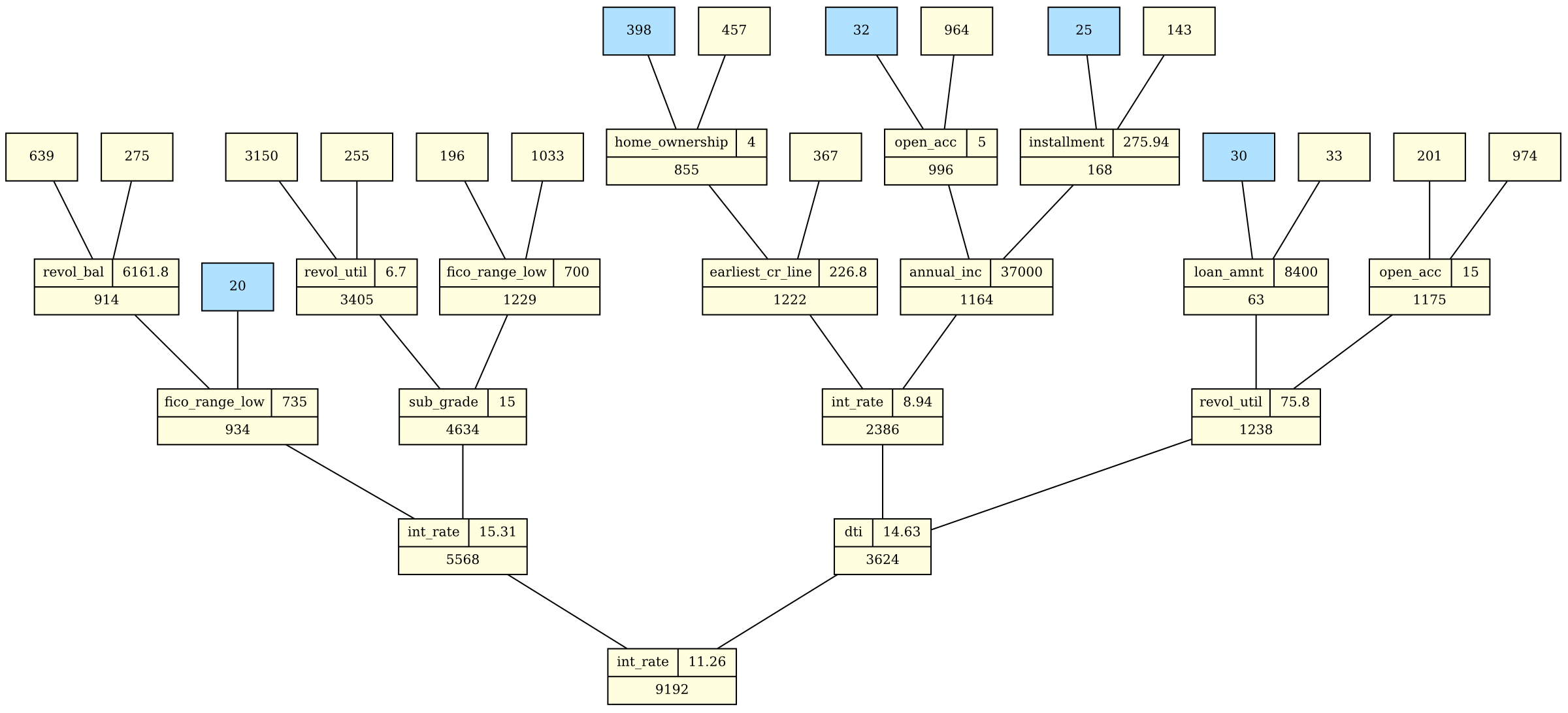

Random forest¶

- Split on the log rank statistic.

- Obtain bootstrap estimates (and variances) of our metrics.

- Easily handle categorical variables and outliers.

Machine Learning: Random forest, construction¶

Take B bootstrap samples of size N.

For each bootstrap sample, build a partitioning tree, $T_b$:

- Select $m < p$ variables as split candidates

- For each split candidate, determine a set of split values

- Compute best split

- Partition the node and recurse

- blue nodes are terminal nodes; size, or statistically homogeneous

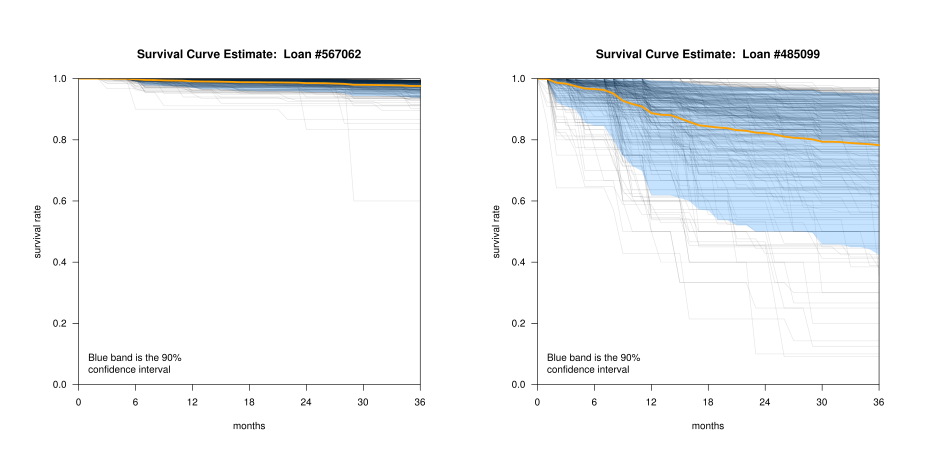

Machine learning: Random forest, scoring¶

Score a loan, $i$, via OOB tree set, $\mathcal{T}_i$:

- For each $t \in \mathcal{T}_i$, find the leaf node that would have contained $i$

- Compute any summary statistics, $S_{i,t}$

- $\mathcal{X}_i = \left\{ S_{i,t} : t \in \mathcal{T}_i \right\}$ is a predictive distribution of the summary statistics associated with loan $i$

Machine Learning: Random forest, survival curves¶

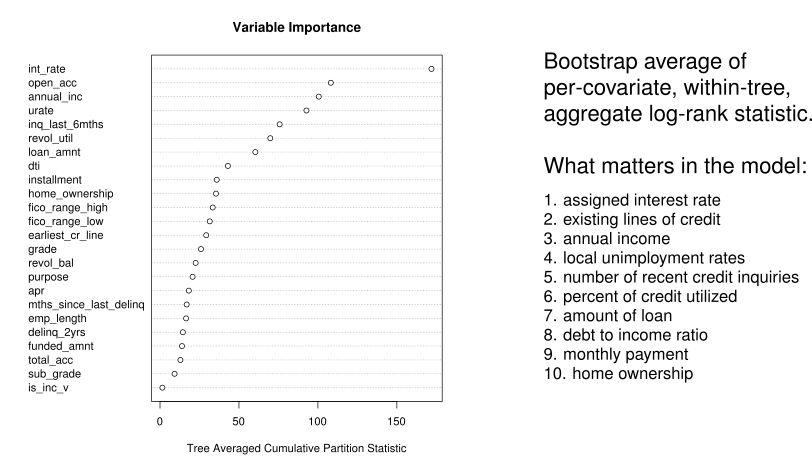

Machine Learning: Variable importance¶

Summary¶

Summary: Using an investor-trained model¶

- Term and loan amounts: likely fixed.

- One remaining free parameter: interest rate or installment.

Analogous to profile likelihood / parameter scan:

- Partition the covariate vector: loan- and user-specific components

- Replace loan-specific components by a set of loan parameters (levels)

- For each query, use the corresponding survival curve to infer IRR, probability of repayment.